Affordable Areas Outside Big Cities Are Heating Up the Fastest As the Pandemic Changes Homebuyers’ Priorities

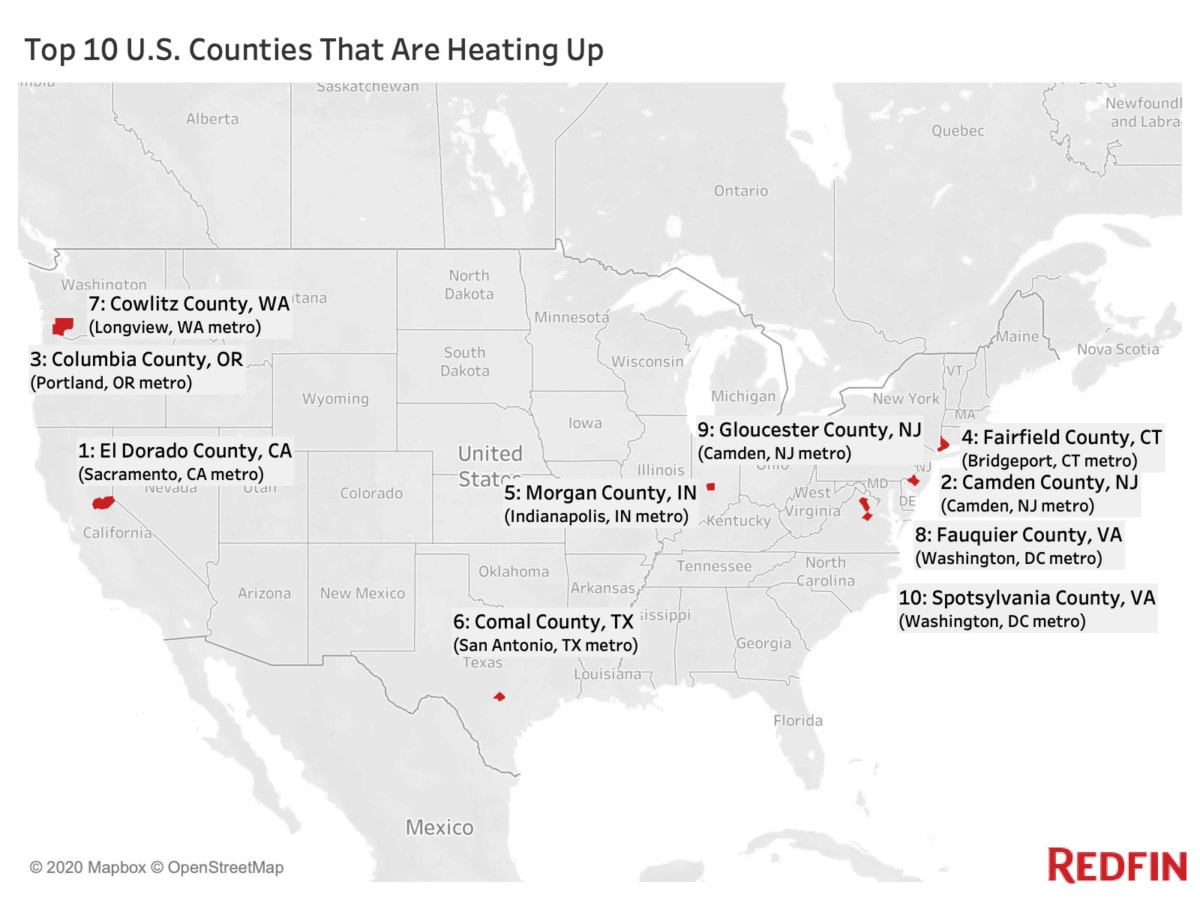

Relatively inexpensive areas outside major cities—like El Dorado County, just east of Sacramento, and Camden County, across the river from Philadelphia—are gaining ground with homebuyers as New York City and San Francisco lose steam.

Housing markets that offer homebuyers more bang for their buck and are located outside of major cities—but within driving distance—are heating up, with relatively affordable places including El Dorado County, CA and Camden County, NJ rising in popularity as house hunters take advantage of remote work and record-low interest rates. Nine of the 10 markets where homebuyer competition has intensified the most since last year have median sale prices below $500,000 despite seeing price growth of at least 10% over the last year.

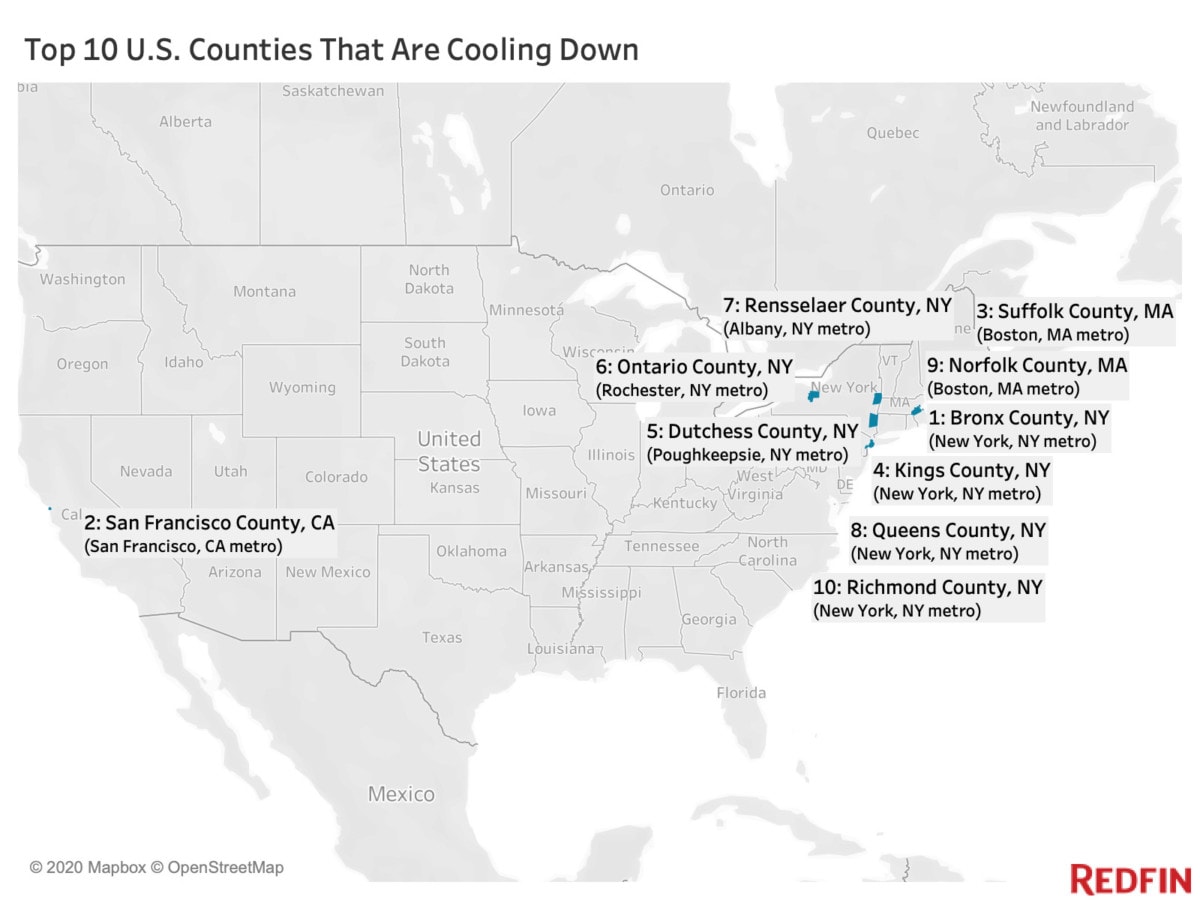

Meanwhile, iconic coastal hubs such as New York and San Francisco are losing their luster as the coronavirus pandemic accelerates an exodus out of dense, expensive job centers. Seven of the 10 markets that have cooled most in the last year are located in New York (including four of the five New York City boroughs; Manhattan was excluded from this analysis due to insufficient data) and seven have median sale prices above $500,000.

This is according to a Redfin ranking of the U.S. housing markets that have heated up and cooled down the most over the past year. Our ranking of the top 10 and bottom 10 U.S. counties is based on year-over-year change in home prices, home sales, the share of homes that sold above their list price, the speed of home sales and Redfin.com searches.

Relatively affordable areas outside big cities—like El Dorado County, CA and Camden County, NJ—are heating up most

El Dorado County, CA came in first place, with measures of homebuyer competition surging faster than any other U.S. county in the last year. Spanning from the eastern outskirts of Sacramento to the southern half of Lake Tahoe (but not including the city of Sacramento, which is in Sacramento County), the region has seen home sales skyrocket nearly 60% over the last year as buyers have flocked from the Bay Area, despite the fact that it’s located in a fire-prone area, with the most recent wildfire igniting in early September. It’s the most expensive county in the top 10, with a median sale price of $550,000, but that’s relatively affordable compared with $1.45 million, the median sale price in nearby San Francisco. Scroll down to see a full table of the top 10 counties.

“We’re seeing a huge influx of buyers coming to El Dorado County from the Bay Area,” said local Redfin agent Ellie Hitchcock. “With so many large tech companies allowing employees to work from home for the foreseeable future, homeowners in San Francisco are selling their two-bedroom, two-bathroom Condo and buying a 5,000-square-foot home with five bedrooms and five bathrooms on an acre of land here for the same price. It’s simply a no-brainer.”

The Sacramento metro area, where El Dorado County is located, was the most popular destination for homebuyers looking to relocate in July, according to an analysis of Redfin.com users. San Francisco was the top origin for out-of-area buyers looking in the Sacramento area.

“The rise of working from home and the need for more space to accommodate that new lifestyle is bringing people to El Dorado County,” Hitchcock continued. “Conveniently, buyers can afford a lot more house today than they could last year due to historically low interest rates”

In second place was Camden County, NJ, a region of southern New Jersey located just across the Delaware River from Philadelphia. Homes in the area have been selling fast, spending a median of 28 days on the market in July, compared with 47 days a year earlier. While prices have climbed 13% since last year, homes still sell for a median of $215,000—well below the national median.

“Camden’s economy has changed dramatically over the course of its history,” said Redfin chief economist Daryl Fairweather. “The city of Camden is still recovering from the devastating effects of housing discrimination and redlining. But more recently, the state of New Jersey has made a concerted effort to revitalize the area by offering corporate tax incentives. The revitalization seems to be improving Camden’s appeal to outsiders, but local first-time homebuyers could see themselves priced out of the market.”

Camden County saw a 500% increase in net inflow of Redfin.com users searching for homes in the second quarter (a net inflow means more people are looking to move in than to leave).

“I’m seeing a lot of buyers coming in from Philly—especially young people who want to stop renting and start owning,” said Jackie Imperato, a Redfin agent in southern New Jersey. “New Yorkers and North Jersey folks are also flocking here because they want to escape the city due to the pandemic.”

Imperato also works in Gloucester County, which is adjacent to Camden County and ranked ninth on the list of markets that have heated up the most.

“You can buy a 3,000-square-foot home with an acre of grounds and a highly rated school district for $350,000 in Gloucester County. In parts of north Jersey, you’d be living in a bungalow for that price,” Imperato added. “With interest rates this low, there are probably a lot more buyers than we know of waiting patiently to find their dream homes, but there just aren’t enough houses for sale.”

The shortage of properties on the market is driving up competition in Gloucester and Camden counties, according to Imperato, who said most homes up for sale are receiving at least five offers. Imperato is working with one buyer from Philadelphia who has made 22 offers in Gloucester County. The client, who has been approved for an FHA home loan, keeps getting beat out by other buyers whose offers are more competitive because they’ve been approved for conventional loans. FHA loans require lower down payments and have a lower credit-score threshold than conventional loans, which is why, in a bidding war, some sellers may view them as less desirable than a conventional loan.

Housing Market Summary of U.S. Counties That Have Heated Up the Most (July 2020*)

| Rank | U.S. County | Parent Metro Area | Median Sale Price | Median Sale Price, YoY Change | Homes Sold, YoY Change | Median Days on Market | Median Days on Market, YoY Change (in Days) | Share of Homes that Sold Above List Price | Q2 Net Inflow of Redfin Users Searching in Area, YoY Change |

| 1 | El Dorado County, CA | Sacramento, CA | $550,000 | 10.0% | 57.3% | 28 | -7 | 32.2% | 107% |

| 2 | Camden County, NJ | Camden, NJ | $215,000 | 13.2% | 9.5% | 28 | -19 | 37.1% | 512% |

| 3 | Columbia County, OR | Portland, OR | $350,000 | 13.3% | 17.3% | 18 | -11 | 40.0% | 78% |

| 4 | Fairfield County, CT | Bridgeport, CT | $490,000 | 16.7% | 34.0% | 70 | 1 | 24.7% | 862% |

| 5 | Morgan County, IN | Indianapolis, IN | $200,000 | 14.3% | 19.1% | 7 | -11 | 32.8% | 133% |

| 6 | Comal County, TX | San Antonio, TX | $342,100 | 9.8% | 44.4% | 55 | -11 | 18.2% | 78% |

| 7 | Cowlitz County, WA | Longview, WA | $329,000 | 17.9% | 26.6% | 9 | -5 | 52.9% | -3% |

| 8 | Fauquier County, VA | Washington, DC | $475,000 | 13.1% | 33.3% | 42 | -8 | 29.7% | -11% |

| 9 | Gloucester County, NJ | Camden, NJ | $224,500 | 12.3% | 10.7% | 31 | -17 | 37.2% | 64% |

| 10 | Spotsylvania County, VA | Washington, DC | $344,950 | 17.8% | 9.1% | 30 | -8 | 36.1% | 15% |

| National | – | $323,000 | 8.1% | 9.8% | 35 | -1 | 29.9% | – |

*Net inflow data covers the second quarter of 2020

Expensive, dense areas—especially in New York—are cooling down

Bronx County, NY, more commonly known as the Bronx, ranked number one on the list of U.S. housing markets that are cooling down. It is one of seven other New York markets, including Brooklyn, Queens and Staten Island, that are in the bottom 10. Home sales in the Bronx have plummeted 43% since last year while the number of Redfin.com users searching in the area dropped 16% in the second quarter.

“People want out of New York City,” said local Redfin agent Ken Wile. “This pandemic has changed everybody’s lives. People who had to commute to the city no longer have to, so they want more space, more value and more nature.”

More than a third (34.2%) of Redfin.com users from the New York metro area looked to relocate in July—a higher share than any other metro.

Many people leaving New York City are moving north to Westchester and Putnam counties, Wile said, though he hasn’t noticed many people leaving New York state altogether.

San Francisco County ranked number two on the list of housing markets that have slowed down the most. New listings skyrocketed 110% year over year in July—a sign that homeowners are fleeing. The San Francisco metro area has seen its supply of homes increase more than any other major metro since the pandemic began, forcing sellers to lower expectations for what they can reap in a sale. The region has seen a greater increase in price drops than any other major metro, with a quarter of sellers cutting prices. Still, San Francisco’s median sale price remains sky-high at nearly $1.5 million.

“I’ve been telling sellers that if they’re not willing to compromise on price after a couple of weeks, they’ll probably be holding onto their home for two to four more years,” said San Francisco Redfin agent Gabrielle Bunker. “A lot of sellers are having a hard time coming to terms with that—they’re really, really wishing that the market was the way that it was six to nine months ago.”

“Between the aging infrastructure, congestion, exorbitant home prices, unresolved concerns for people who are experiencing homelessness, and now the pandemic, some people are over San Francisco,” Bunker continued. “We have renters here who are 30 years old, running huge budgets for their companies, making $150,000 a year, and are still living with roommates because they can’t afford to buy a home. And for homeowners, the area’s property tax dollars can become frustrating when city services and improvements are out of step with large bi-annual tax payments.”

“For years, people have been sticking around San Francisco for work even though they weren’t necessarily loving the San Francisco experience. Now they’re seeking out greener pastures because they finally can, with employers letting workers relocate in exchange for slightly reduced salaries,” Bunker added. “What I’m seeing is people getting out of the city but staying local—they’re looking in places like Sausalito and Mill Valley. They don’t want to go too far because the Bay Area still has a lot to offer, like proximity to Lake Tahoe and wine country.”

Housing Market Summary of U.S. Counties That Have Cooled Down the Most (July 2020*)

| Rank | U.S. County | Parent Metro Area | Median Sale Price | Median Sale Price, YoY Change | Homes Sold, YoY Change | Median Days on Market | Median Days on Market, YoY Change (in Days) | Share of Homes that Sold Above List Price | Q2 Net Inflow of Redfin Users Searching in Area, YoY Change |

| 1 | Bronx County, NY (The Bronx) | New York, NY | $525,000 | 5.2% | -43.3% | 75 | 10 | 18.3% | -16% |

| 2 | San Francisco County, CA | San Francisco, CA | $1,450,000 | 0.0% | -4.9% | 24 | 5 | 53.0% | -7% |

| 3 | Suffolk County, MA | Boston, MA | $661,000 | 0.5% | -8.7% | 21 | 5 | 39.3% | -10% |

| 4 | Kings County, NY (Brooklyn) | New York, NY | $825,000 | -9.8% | -50.7% | 110 | 6 | 7.7% | 5% |

| 5 | Dutchess County, NY | Poughkeepsie, NY | $328,000 | 2.5% | -13.8% | 71 | 22 | 24.4% | -117% |

| 6 | Ontario County, NY | Rochester, NY | $204,000 | -11.9% | -31.2% | 20 | 3 | 40.2% | -125% |

| 7 | Rensselaer County, NY | Albany, NY | $188,040 | -1.0% | -12.9% | 30 | 3 | 38.0% | -243% |

| 8 | Queens County, NY (Queens) | New York, NY | $550,000 | -6.8% | -38.6% | 89 | 23 | 11.7% | 160% |

| 9 | Norfolk County, MA | Boston, MA | $560,000 | 2.7% | -7.3% | 21 | 5 | 45.7% | -167% |

| 10 | Richmond County, NY (Staten Island) | New York, NY | $550,000 | 0.0% | -38.8% | 61 | 16 | 7.9% | -65% |

| National | – | $323,000 | 8.1% | 9.8% | 35 | -1 | 29.9% | – |

*Net inflow data covers the second quarter of 2020

Methodology

This report provides a prediction of the U.S. housing markets that have heated up and cooled off the most by creating a ranking of U.S. counties based on year-over-year growth in the following metrics in July 2020: median sale price, median days on market, number of homes sold and share of homes that sold above list price. To make it into the ranking, counties had to have at least 30 home sales in July 2020. The net inflow of Redfin.com users searching online for homes in each county during the second quarter also factored into the ranking.

The post Affordable Areas Outside Big Cities Are Heating Up the Fastest As the Pandemic Changes Homebuyers’ Priorities appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.