The Ultimate Guide to Buying a House in Maryland

Looking for a place to call your own in the beautiful state of Maryland? From the sandy beaches of Ocean City to the bustling city life of Baltimore, there is no shortage of unique and charming communities. However, buying a house is more than just a transaction; it’s a life-changing experience. Whether you’re a first-time homebuyer or a seasoned pro, finding and purchasing a home can be both exhilarating and overwhelming. That’s why Redfin is here to guide you through the ins and outs of buying a house in Maryland, so you can make your dream of homeownership a reality. So, sit back, relax, and let’s get started.

What’s it like to live in Maryland?

Living in Maryland can be an incredible experience, with its unique small towns, historic landmarks, scenic landscapes, and lively cities. Whether you enjoy hiking along the Appalachian Trail, soaking up the sun at the Chesapeake Bay, or exploring the vibrant art scene in Baltimore, there is something for everyone’s lifestyle here. The state is also renowned for its delicious seafood, from crab cakes to oysters, and its rich cultural heritage, with countless museums, galleries, and festivals showcasing its diverse history and traditions. However, living in Maryland can also come with challenges, such as hot and humid summers, traffic congestion in larger cities, and high living expenses in some areas. Check out this article to learn more about the pros and cons of living in Maryland.

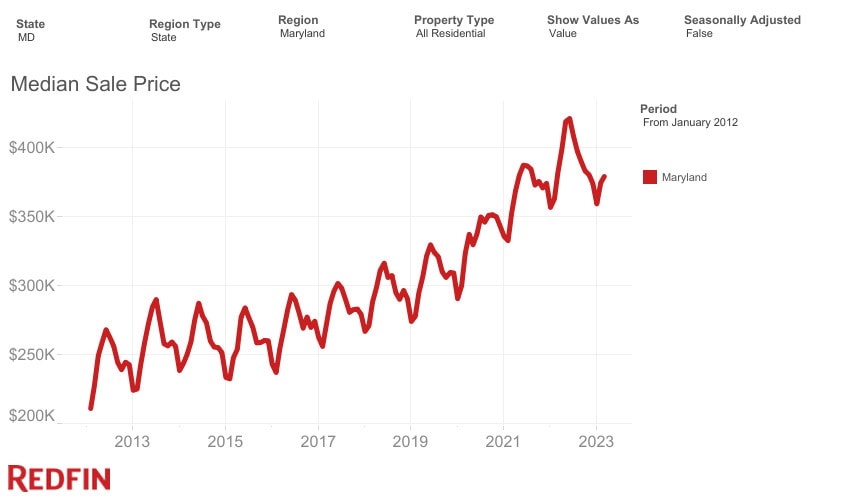

Maryland housing market insights

Maryland’s housing market has been experiencing high demand over the last couple of years, with limited inventory contributing to increased home prices in some areas. Despite spiking interest rates, competition remains fierce in areas, including Bel Air South, Catonsville, and Ilchester, where homes are selling quickly, often within days of being listed despite the average of 32 days. The median sale price in Maryland is currently $379,000, which is lower than the national median sale price of $400,400.

Finding your perfect location in Maryland

Finding the right location is crucial when buying a house in Maryland, as it can significantly impact your life and overall satisfaction with your home. Maryland is a diverse state with a range of urban, suburban, and rural areas, each with a unique character and lifestyle. The location of your home can affect factors such as commute time, access to amenities, and proximity to friends and family.

To give you a head start, we’ve compiled some market insights on some of the most popular cities in Maryland, including some market insights. And if you need help choosing between two equally appealing options, you can use tools like a cost of living calculator to help find the perfect city that fits your budget.

#1: Baltimore, MD

Median home price: $200,000

Baltimore, MD homes for sale

Baltimore, Maryland’s largest city, is a vibrant and historic city with a unique character and culture. The city is home to several world-class museums, such as the Baltimore Museum of Art and the Walters Art Museum, and a vibrant theater community that includes the historic Hippodrome Theatre. The Inner Harbor, Baltimore’s central waterfront, is a popular destination for locals and tourists, featuring restaurants, shops, and attractions such as the National Aquarium. If moving to Baltimore sounds like the right fit for you, check out these great Baltimore suburbs.

#2: Gaithersburg, MD

Median home price: $524,000

Gaithersburg, MD homes for sale

Moving to Gaithersburg means you’ll be in a suburban city with a diverse and welcoming community. The city boasts an excellent school system with top-rated universities like Johns Hopkins University and the University of Maryland, making it a popular destination for families. Gaithersburg also offers a variety of recreational opportunities, including parks, hiking, biking trails, and community events such as the Gaithersburg Book Festival and the Montgomery County Agricultural Fair.

#3: Rockville, MD

Median home price: $561,000

Rockville, MD homes for sale

If you’re considering moving to Rockville, you’ll be pleased to know that it’s an ideal place for those who love the great outdoors and community events. The city offers a variety of outdoor fun including parks, hiking, biking trails, and the popular Rockville Farmers Market and Hometown Holidays Music Festival. And that’s not all. The city has a strong economy, with several major employers, such as the National Institutes of Health and Lockheed Martin, located in the area. With its vibrant community, excellent amenities, and thriving job market, Rockville is truly a city that has it all, making it a wonderful place to call home.

#4: Annapolis, MD

Median home price: $612,000

Annapolis, MD homes for sale

As the capital of Maryland, Annapolis holds rich history and beauty. Known for its picturesque waterfront and rich maritime heritage, Annapolis offers a unique coastal lifestyle. The city is home to the United States Naval Academy and several historic sites, such as the Maryland State House and the William Paca House and Garden.

The city’s downtown area is filled with a variety of restaurants, shops, and boutiques, and the popular Annapolis City Dock offers scenic views of the Chesapeake Bay and access to boat tours, kayaking, and other water activities. Additionally, Annapolis hosts several annual events, such as the Annapolis Boat Show and the Maryland Renaissance Festival, that draw visitors from around the region.

#5: Frederick, MD

Median home price: $425,000

Frederick, MD homes for sale

Frederick is a treasure trove of historical sites, including the Monocacy National Battlefield and the Schifferstadt Architectural Museum. Strolling through the charming downtown area, you’ll find an abundance of dining options, unique shops, and boutiques that cater to a wide range of tastes. For those who love the great outdoors, the popular Carroll Creek Park is the perfect place to take in scenic views and indulge in outdoor recreation. And if you’re a fan of community events, Frederick hosts several annual festivals, such as the Frederick Festival of the Arts and the Great Frederick Fair, which draws visitors from all over the region. With so much to offer, it’s easy to see why moving to Frederick is a dream come true for many.

The homebuying process in Maryland

If Maryland has captured your heart and your sights set on a particular area, it’s time to delve into how to buy a home in that neighborhood.

1. Focus on your finances first

Getting your finances in order before searching for homes for sale in Maryland is essential to ensure a smooth home buying process. This includes reviewing your credit score, saving for a down payment, and determining your budget for monthly mortgage payments. By clearly understanding your financial situation and using resources like an affordability calculator, you can avoid potential setbacks, such as loan rejections or unexpected expenses.

Various programs are available for first-time homebuyers in Maryland, including the 1st Time Advantage 5000, which can assist with up to $5,000 in down payment and closing costs.

2. Get pre-approved from a lender

Getting pre-approved from a lender before you start touring or looking for homes is another important part of buying a home in Maryland. Pre-approval involves a lender evaluating your financial situation and creditworthiness and determining the maximum amount of money they will lend you for a home purchase. Having a pre-approval letter in hand when you start your search shows sellers that you are a serious buyer and can afford the homes you are interested in. It also helps you set realistic expectations about your budget and avoid disappointment from falling in love with a home out of your price range.

3. Connect with a local agent in Maryland

To ensure a successful home buying experience, it’s essential to connect with a local real estate agent in Maryland before you start searching for homes on sale. Whether you need a real estate agent in Baltimore or looking for Annapolis agents, a local agent has the expertise and knowledge of the Maryland real estate market, including neighborhoods, school districts, and local amenities, to help you find the perfect home. They can also provide valuable insights on current market trends and pricing and help you navigate the complex home buying process, from making offers to negotiating contracts.

4. Search for homes

During home tours, look for features that are important to you, such as the number of bedrooms and bathrooms, the size of the yard, and the overall condition of the home. You should also pay attention to the neighborhood and its proximity to schools, shopping, and other amenities. Once you find a home you like, your agent will help you make an offer and negotiate a price with the seller. After the offer is accepted, you will conduct a home inspection and appraisal to ensure the home is in good condition and worth the price.

5. Make an offer

The offer is a crucial step in the home buying process, as it sets the terms and conditions for the purchase of the property. It typically includes the purchase price, the amount of earnest money, any contingencies or needs, and the closing date. The offer is significant because it serves as a starting point for negotiations with the seller and ultimately determines whether or not the sale will proceed. Additionally, contingencies or conditions in the offer, such as a home inspection or financing contingency, can protect the buyer’s interests and give them an out if the home does not meet their expectations.

6. Close on the house

Closing on a home in Maryland is the final step in the home buying process. This is where the buyer and seller sign legal documents, and the buyer pays the remaining balance and closing costs to complete the purchase. By taking the time to understand the closing process and working with a real estate agent, buyers can ensure a smooth and successful closing on their new Maryland home. Check out this final walk-through checklist before closing to learn more.

Redfin’s First-Time Homebuyer Guide is an invaluable resource that can offer a comprehensive understanding of each step involved in buying a home, making it an excellent tool for those new to the homebuying process.

Factors to consider when buying a house in Maryland

When purchasing a property in Maryland, it’s crucial to consider specific factors such as loan options, tax implications, insurance requirements, and disclosures.

Transfer tax

When buying or selling real estate in Maryland, it’s important to understand the transfer tax that’s imposed by the state. This tax can be paid by either the buyer or seller, depending on the specific jurisdiction and terms of the sale. The transfer tax rate varies depending on the property’s location, with state and county transfer taxes ranging from 0.5% to 2.5% of the sale price. On top of that, some local jurisdictions in Maryland may have their own transfer taxes, which can add to the overall cost of the sale. The transfer tax is typically due at closing when the title is transferred from the seller to the buyer. The settlement agent or title company will collect the transfer tax from both parties and submit it to the appropriate county or state agency. It’s important to remember that the transfer tax is due within 30 days of the transaction, and failing to pay it on time can result in penalties or interest charges.

High property taxes

Maryland is known for having some of the highest property tax rates in the United States, which can make homeownership more expensive. Property taxes in Maryland are assessed at both the state and local levels and are based on the property’s assessed value. Maryland’s average effective property tax rate is 1.07%, which is lower than the national average of 1.11%. However, property tax rates vary widely depending on the county and municipality where the property is located. For example, in Montgomery County, the property tax rate is 0.99% of the assessed value, while in Baltimore City, the rate is 2.248%.

Dual Agency

Dual agency is legal in Maryland, meaning a real estate agent can represent both the buyer and the seller in a real estate transaction. This can create a conflict of interest for the agent, as they have a duty to act in the best interests of both parties. However, Maryland law requires agents to disclose their dual agency status to both the buyer and seller and obtain written consent from both parties before proceeding with the transaction. Buyers should be aware of the potential drawbacks of dual agency and consider hiring their buyer’s agent to represent their interests during the homebuying process.

Buying a house in Maryland: Bottom line

Purchasing a home in Maryland can be an exciting and fulfilling experience. However, you’ll want to prepare yourself and become knowledgeable about the unique aspects of the homebuying process in the Old Line State. This includes considering factors such as climate and location, working with a local real estate agent, and obtaining pre-approval. Furthermore, with Maryland having one of the highest property tax rates in the nation, it’s crucial to budget accordingly and explore any tax relief programs available to you. By taking these steps, you can increase your chances of finding your dream home in Maryland and make the most of your homeownership journey.

Buying a house in Maryland FAQ

What credit score do you need to buy a house in Maryland

In Maryland, having a good credit score is vital to qualify for a mortgage and obtain favorable loan terms. Generally, a credit score of at least 620 is considered the minimum required to qualify for a mortgage in Maryland, but many lenders prefer to see a higher score, such as 680 or above, in order to provide more competitive interest rates and loan terms. It is important to note that credit scores are not the only factor lenders consider when evaluating mortgage applications. Other factors such as income, employment history, and debt-to-income ratio will also be considered. Check out this article on how to improve your credit score.

How much is a down payment for a house in Maryland

The down payment required to purchase a house in Maryland varies depending on several factors, including the purchase price of the home and the type of loan. Generally, conventional mortgages require a down payment of at least 3.5%-20% of the purchase price. Still, some lenders may require a higher percentage, particularly for borrowers with lower credit scores or higher debt-to-income ratios. The down payment requirements for government-backed loans, such as FHA or VA loans, can be as low as 3.5% of the purchase price. In some cases, buyers may also be able to use down payment assistance programs, which can help reduce or eliminate the down payment requirement. Learn more about how to save for a down payment.

Is now a good time to buy a house in Maryland?

Maryland’s housing market is currently experiencing a seller’s market, with reduced inventory and competitive cities resulting in increased home prices in some areas. Thus, it’s crucial to conduct extensive research and consider various factors such as personal financial circumstances, long-term goals, and the state of the housing market before making any decisions about purchasing a home, especially during a spike in rates. Collaborating with a local real estate agent and a financial advisor is highly recommended to make well-informed decisions about buying a house in Maryland.

The post The Ultimate Guide to Buying a House in Maryland appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.