The Ultimate Guide to Buying a House in North Carolina

Welcome to the Tar Heel State, where the serene landscapes, vibrant cities, and rich cultural heritage await those seeking a place to call home. Whether you’re a first-time homeowner, an investor, or new to the state and considering buying a house in North Carolina, you’re in for a treat. North Carolina boasts many remarkable features, from its picturesque landscapes to its diverse communities and robust economy, offering boundless opportunities. With an extensive array of housing choices, ranging from spacious homes in Greensboro to downtown Durham condos and charming coastal houses in Wilmington, there’s an ideal match for every lifestyle.

If you need help figuring out where to start, Redfin has your back. From market insights and the homebuying process, read on to make the jump to homeownership.

What’s it like to live in North Carolina?

Living in North Carolina is an experience that encapsulates the best of both worlds. The state’s diverse geography offers a remarkable blend of natural beauty and urban convenience. Those residing here enjoy a mild climate, with four distinct seasons, allowing various outdoor activities throughout the year. Whether hiking the scenic trails of the Blue Ridge Mountains, exploring the pristine beaches along the Atlantic coast, or immersing oneself in charming small towns and vibrant cities, North Carolina offers a wealth of recreational opportunities. Check out this article to learn more about the pros and cons of living in North Carolina.

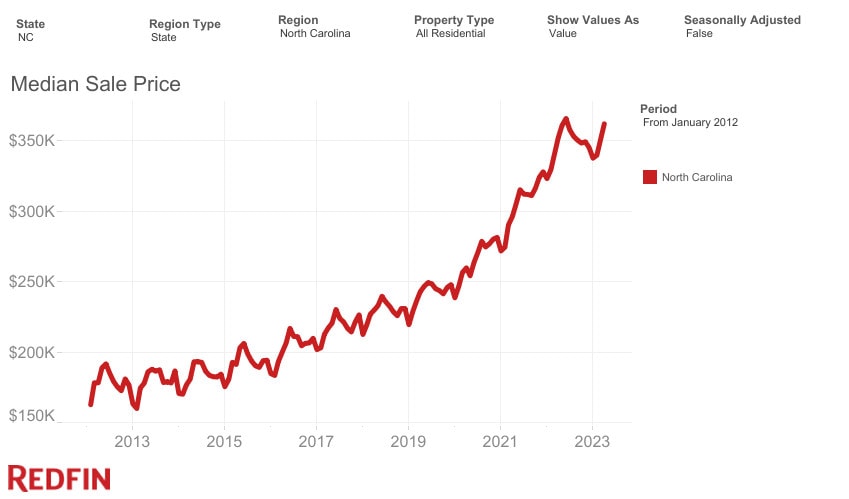

North Carolina housing market insights

The housing market in North Carolina is a vibrant and flourishing industry that presents potential buyers with numerous choices. One aspect that makes this market particularly enticing is its affordability in comparison to other areas. This affordability is evident through a median sale price of $361,000, which is below the national median of $407,415. Despite a decrease in housing demand, the median sale price continues to rise steadily, with a noteworthy 2.5% year-over-year increase. When it comes to competitive markets, Murraysville, Half Moon, Jacksonville, and Fayetteville stand out as the top contenders.

Finding your perfect location in North Carolina

North Carolina offers a wide range of diverse regions, each with its unique characteristics, attractions, and amenities. The choice of location determines the quality of life you will experience, influencing factors such as proximity to job opportunities, schools, healthcare facilities, recreational activities, and community engagement.

We’ve gathered market insights on several highly sought-after cities in North Carolina to start you on your home search. Additionally, suppose you find yourself torn between two equally enticing options. In that case, you can utilize helpful tools such as a cost of living calculator to identify the ideal city that aligns with your budget.

#1: Greensboro, NC

Median home price: $258,000

Greensboro, NC homes for sale

Moving to Greensboro offers a unique blend of vibrant city life and a strong sense of community. Located in the heart of North Carolina’s Piedmont region, Greensboro provides residents with many amenities and opportunities. The city boasts a thriving arts and cultural scene, with renowned venues such as the Greensboro Coliseum Complex and the Carolina Theatre hosting concerts, performances, and exhibitions year-round. The city’s diverse neighborhoods offer a range of affordable suburbs, from historic districts like Fisher Park to modern developments in the suburbs. The downtown area is bustling with restaurants, shops, and entertainment venues, while the abundance of parks and green spaces, like the Greensboro Arboretum and the Bog Garden, provide opportunities for outdoor recreation.

#2: Wilmington, NC

Median home price: $390,000

Wilmington, NC homes for sale

A coastal paradise where history, natural beauty, and a vibrant community converge is what makes Wilmington a good place to live. Situated along the Cape Fear River and minutes away from pristine beaches, Wilmington offers a unique coastal lifestyle that attracts residents and visitors alike. The city is known for its charming downtown district, featuring a picturesque riverfront, cobblestone streets, and a lively arts and dining scene. Residents can explore the historic district’s beautifully preserved homes, stroll along the scenic Riverwalk, or enjoy a boat ride.

#3: Charlotte, NC

Median home price: $399,188

Charlotte, NC homes for sale

As North Carolina’s largest city, moving to Charlotte provides a wealth of opportunities for residents. Charlotte’s skyline is adorned with impressive skyscrapers, and the city is home to the significant headquarters of renowned companies such as Bank of America, Lowe’s Inc., and Duke Energy. In addition to its economic prowess, Charlotte offers a vibrant arts and cultural scene, with numerous theaters, museums like the Mint Museum, and galleries showcasing local and international talent. Check out these affordable Charlotte suburbs if you’re looking for a more budget-friendly alternative to city life.

#4: Raleigh, NC

Median home price: $399,470

Raleigh, NC homes for sale

Raleigh, the capital of North Carolina, is known for its beautiful parks and green spaces, including the stunning William B. Umstead State Park and the picturesque Pullen Park. Moving to Raleigh, you’ll be surrounded by numerous museums, such as the North Carolina Museum of Natural Sciences, the North Carolina Museum of Art, and the Marbles Kids Museum. The city is also a hotbed for technology and research, with the Research Triangle Park (RTP) nearby, attracting top-notch companies and fostering innovation. Many beautiful neighborhoods surround the city, so if you’re on a budget, check out these affordable suburbs.

#5: Durham, NC

Median home price: $400,000

Durham, NC homes for sale

Known as the “Bull City,” Durham is home to rich history showcased through its revitalized tobacco warehouses, now transformed into trendy shops, restaurants, and art galleries. Durham is also a thriving center for research and education, with prestigious universities like Duke University and North Carolina Central University contributing to an intellectual atmosphere. Durham has the highest median sale price out of the cities listed, with a 4% higher cost of living than Raleigh. Although this city is more expensive, looking at affordable Durham suburbs will help you stay on budget.

The homebuying process in North Carolina

If you have fallen in love with North Carolina and have your eyes set on a specific area, it’s time to explore the steps to purchasing a home in that neighborhood.

1. Prioritize your finances

Getting your finances in order is crucial for the homebuying process in North Carolina, as it sets the foundation for a smooth and successful transaction. Firstly, having your finances in order allows you to determine your budget and understand how much you can comfortably afford to spend on a home. This helps you narrow your search and focus on properties within your price range, saving you time and avoiding disappointment. Using tools like the affordability calculator will help you determine your budget.

Various programs are available for first-time homebuyers in North Carolina, including the NC 1st Home Advantage Down Payment, which can assist with up to $8,000 in down payment assistance.

2. Get pre-approved from a lender

Getting pre-approved from a lender is equally important with several significant benefits. Through pre-approval, a lender thoroughly assesses your financial situation, including income, credit history, and debt-to-income ratio, to determine the maximum loan amount they are willing to lend you. This allows you to confidently search for homes within your budget and make realistic offers.

3. Connect with a local agent in North Carolina

Connecting with a local real estate agent in North Carolina is essential when navigating the complexities of the housing market. A knowledgeable and experienced agent is your guide, offering valuable insights and expertise specific to the local area. Whether you need a real estate agent in Raleigh or an agent in Greensboro, they have in-depth knowledge of neighborhoods, market trends, pricing dynamics, and available listings, saving you time and effort in your home search.

4. Start touring homes

Touring is important because it allows you to explore various neighborhoods, evaluate available properties, and find the perfect home. Conducting a thorough search enables you to familiarize yourself with the local real estate market, understand pricing trends, and identify potential opportunities. Touring a home is a great way to determine what size you’re looking for, noise levels and remodeling opportunities, so you can set a path for your future.

5. Make the offer

Making a strong and competitive offer is essential because it positions you as a serious buyer and increases your chances of securing the home. By carefully considering the market value, comparable sales, and the property’s condition, you can make a fair offer that aligns with your budget and the property’s worth. In a competitive market, where multiple requests may be involved, compelling offers can give you an edge over other potential buyers.

6. Close on the house

The closing process is the final step in the home buying journey, where property ownership officially transfers from the seller to the buyer. It is a critical milestone that ensures the transaction’s legal and financial aspects are properly executed. By completing the closing process, buyers gain the assurance that the property’s title is clear, all necessary documentation is in order, and any outstanding financial obligations are settled. This includes paying closing costs, signing the mortgage documents, and obtaining homeowner’s insurance.

The Redfin First-Time Homebuyer Guide is a great resource, offering a thorough comprehension of the various stages involved in purchasing a home.

Factors to consider when buying a house in North Carolina

When buying a property in North Carolina, it is essential to consider specific elements, including natural disasters, insurance options, and disclosures.

Attorney state

North Carolina is an attorney state, meaning involving an attorney in the home buying process is a customary and often necessary practice. In this state, real estate attorneys play a crucial role in ensuring the transaction’s legal aspects are completed. They help with various tasks, such as reviewing and drafting contracts, conducting title searches, facilitating the closing process, and ensuring compliance with state and local laws.

Natural disasters

Obtaining the proper homeowner’s insurance in North Carolina is very important, given the state is prone to various natural disasters. The state experiences weather-related events, including hurricanes, tropical storms, flooding, and occasional tornadoes. These natural hazards can cause significant damage to properties and belongings. Appropriate homeowners insurance coverage is essential to protect your investment and provide financial security in a disaster. It’s important to review the insurance policy carefully, ensuring it includes coverage for specific risks prevalent in North Carolina.

Coastal development and zoning

North Carolina’s coastal areas are subject to specific development and zoning regulations, making it crucial to understand these factors during home buying. The state’s beautiful coastline is desirable for its natural beauty, potential risks, and environmental considerations. Coastal development regulations aim to protect the delicate coastal ecosystem and sustainably manage growth. Zoning restrictions may limit the type of construction, setback requirements, and height restrictions to preserve the character and integrity.

Historic Preservation

There are numerous historic preservation communities in North Carolina, and understanding their significance is essential during the homebuying process. These communities are dedicated to preserving and protecting historically significant properties and neighborhoods, showcasing the state’s rich cultural heritage. When considering a historic home, it is essential to understand the specific regulations and guidelines that govern modifications, renovations, and exterior appearances. These regulations are in place to maintain the authenticity and architectural integrity of the properties.

Buying a house in North Carolina: Bottom line

North Carolina has something for everyone, from the beautiful coastal areas to the scenic mountains and welcoming cities. Throughout the homebuying process, it is crucial to consider factors such as location, budget, financing options, inspections, and local regulations. Understanding the aspects of North Carolina’s housing market, will help buyers make informed decisions about making this state their home.

Buying a house in North Carolina FAQ

Is North Carolina a good state to buy a house?

The state offers diverse housing options, from coastal properties to mountain retreats and bustling urban areas. North Carolina has a relatively low cost of living compared to many other states, making homeownership more affordable. Additionally, North Carolina’s natural beauty, mild climate, and abundant recreational activities make it an attractive place to live. However, it’s essential to consider local market conditions and insurance requirements when buying a house in North Carolina. Engaging local real estate experts and diligent research will ensure that your home purchase in North Carolina meets your needs.

How much money do you need to buy a house in North Carolina?

The amount of money needed to buy a house in North Carolina can vary depending on various factors. Generally, buyers should consider having enough funds for a down payment, closing costs, and other associated expenses. The down payment is typically a percentage of the home’s purchase price and can range from 3% to 20% or more, depending on the type of mortgage loan and the buyer’s financial situation. Closing costs, which include fees such as loan origination, appraisal, title insurance, and attorney fees, can range from 2% to 5% of the purchase price. Seeking guidance from a mortgage lender or real estate expert will clarify the financial prerequisites for a home in North Carolina.

How much do you need for a down payment on a house in North Carolina?

The general range for down payments in North Carolina is typically between 3% and 20% of the home’s purchase price. For example, if you purchase a $300,000 home, a 3% down payment would amount to $9,000, while a 20% down payment would be $60,000. The specific down payment required will depend on various factors, including the type of mortgage loan and your credit score. Some loan programs, such as FHA loans, may offer lower down payment options, such as 3.5% of the purchase price. Making a higher down payment can have advantages, such as potentially securing a lower interest rate.

The post The Ultimate Guide to Buying a House in North Carolina appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.