The Ultimate Guide to Buying a House in Oregon

Are you a first-time homebuyer dreaming of settling down in the picturesque landscapes of the Pacific Northwest? If so, Oregon might be the perfect place to call home. With its diverse geography, vibrant cities, and a unique blend of urban and natural beauty, buying a house in Oregon offers many opportunities for those seeking to live in a stunning state.

Whether you’re drawn to the bustling city life of Portland or the charming coastal communities along the Pacific Ocean like Florence, this Redfin article will guide you through the essential considerations and steps in purchasing your dream home in Oregon. Prepare to embark on an exciting journey to homeownership in the Beaver State.

What’s it like to live in Oregon?

Living in Oregon is a remarkable experience, characterized by a harmonious blend of natural beauty and cultural vibrancy. The state boasts diverse landscapes, from the rugged coastline along the Pacific Ocean, where you can explore the dramatic cliffs of Cannon Beach, to the lush forests of the Cascade Range, home to the majestic Mount Hood. You’ll find a strong appreciation for the outdoors in this state. Take a look at this article to learn more about the pros and cons of living in Oregon.

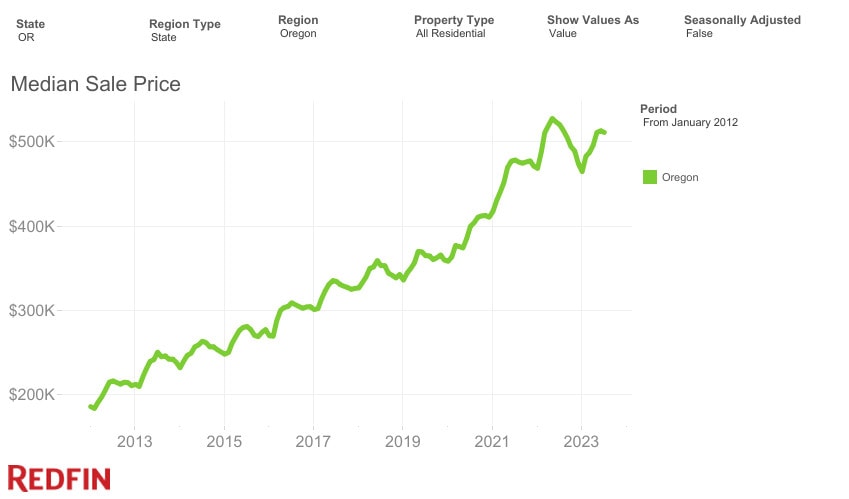

Oregon housing market insights

The Oregon housing market reflects a mixed landscape in recent times. The median sale price, currently at $511,100, has seen a modest decline of 1.7% year-over-year. However there are areas of the state where the sales prices are growing at a faster rate. A few of these cities include Coos Bay, Bethany, and Lake Oswego. This disparity can be attributed to decreased supply and demand dynamics, with some regions experiencing a shortage of available homes, driving up prices and fostering a competitive atmosphere. Cities like Bull Mountain, Oak Hills, and Oatfield stand out as some of the most competitive in the state’s housing market, where buyers face stiff competition in their quest for a new home.

Finding your perfect location in Oregon

Selecting the right location when purchasing a home in Oregon is paramount, as it directly influences your daily life and overall satisfaction. With Oregon’s diverse landscapes and communities, your chosen location can determine your access to outdoor activities, cultural amenities, and job opportunities. Tools like a cost of living calculator can help you find a city within your budget. And if you don’t know where to start, here are five of Oregon’s most popular cities.

#1: Salem, OR

Median home price: $449,000

Salem, OR homes for sale

Living in Salem offers a quieter, more relaxed pace of life compared to its larger neighbor, Portland. The city is steeped in history, with attractions like the Oregon State Capitol and the Deepwood Estate providing a glimpse into its past. Salem’s proximity to the Willamette Valley wine country allows residents to taste wine at renowned vineyards such as Willamette Valley Vineyards.

#2: Eugene, OR

Median home price: $523,000

Eugene, OR homes for sale

The city is home to the University of Oregon, infusing a youthful energy and a love for collegiate sports into the community. Moving to Eugene, you’ll be surrounded by an abundance of outdoor recreational activities, with the Willamette River offering opportunities for kayaking and biking. The cost of living in Eugene is 14% higher than the national average, so If you’re looking for more affordable suburbs, there are plenty of charming neighborhoods to choose from.

#3: Portland, OR

Median home price: $530,000

Portland, OR homes for sale

Moving to Portland offers a unique blend of urban charm and natural beauty. The city is renowned for its thriving arts scene, with numerous galleries, theaters, and music venues like the iconic Crystal Ballroom. Residents also enjoy easy access to outdoor adventures. Portland is nestled amidst the stunning Pacific Northwest landscapes, providing opportunities for hiking in Forest Park or exploring the scenic Columbia River Gorge. The cost of living in Portland is 8% higher than in Eugene, but there are several affordable suburbs in Portland to choose from.

#4: Hillsboro, OR

Median home price: $542,900

Hillsboro, OR homes for sale

For those searching for a suburban atmosphere with a strong sense of community, check out Hillsboro. The city offers a great environment, good schools, and a variety of parks and outdoor spaces for recreational activities. With its tech-focused economy and proximity to major employers like Intel, Hillsboro also provides ample job opportunities, making it an attractive place to call home.

#5: Bend, OR

Median home price: $784,900

Bend, OR homes for sale

Bend is an outdoor enthusiast’s dream come true. Surrounded by the stunning Cascade Mountains, it’s a hub for hiking, skiing, and biking adventures. The city’s vibrant downtown, with its craft breweries and lively arts scene, fosters a welcoming and active community.

The homebuying process in Oregon

Once you’ve narrowed down your perfect location in the Beaver State, it’s time to prepare for buying a home in Oregon. Here are the most important steps of the homebuying process.

1. Prioritize your finances

Before buying a house in Oregon, you must prioritize your finances by assessing your budget, factoring in not just the down payment and mortgage but also property taxes, insurance, and ongoing maintenance costs. Utilizing tools like an affordability calculator can help you determine a comfortable price range for your home purchase and ensure your financial stability in the long term.

Various programs are available for first-time homebuyers in Oregon, including the Oregon Bond Residential Loan Program Cash Advantage, which includes a grant of 3% of the total loan amount that can be used for closing costs assistance.

2. Get pre-approved for a mortgage

Pre-approval involves a thorough assessment of your financial situation, creditworthiness, and potential loan options. Getting preapproved for a mortgage provides a clear picture of how much house you can afford, streamlining your home search. In Oregon’s competitive markets, this preapproval can give you a significant advantage, as sellers tend to prefer buyers who appear financially prepared. Also, having a preapproval can expedite the entire buying process, ensuring a smoother and more efficient home-buying experience.

3. Connect with a local agent in Oregon

Oregon’s local real estate agent is crucial because they possess in-depth knowledge of the area’s housing market, neighborhoods, and local regulations, ensuring you make informed decisions and find the ideal home. So whether you need a real estate agent in Portland or an agent in Beaverton, they’re here to help.

4. Start touring homes

When touring a home in Oregon, consider important factors like the overall condition, layout, natural lighting, and potential maintenance needs. It’s a hands-on experience that helps you make a well-informed decision and ensures the house fits your needs and expectations.

5. Make the offer

Making an offer on the house is a crucial step in the homebuying process. It’s where you put your intentions into action, specifying the price you’re willing to pay, contingencies, and other terms. Carefully crafting your offer with the help of your real estate agent is essential to negotiate effectively and secure the property you desire.

6. Close on the house

The closing process is the final step in buying a house, and it involves signing all the necessary paperwork to transfer ownership from the seller to you. It’s a crucial part of the homebuying journey, where details like the title search, inspections, and financing are finalized.

For more information regarding the homebuying process, check out Redfin’s First-Time Homebuyer Guide.

Factors to consider when buying a house in Oregon

Carefully consider location, budget, and long-term lifestyle goals to make a well-informed decision that aligns with your needs and preferences.

Sales and property taxes

One enticing aspect of buying a house in Oregon is the absence of a statewide sales tax, which means you won’t be paying additional taxes on standard goods. However, it’s important to note that property taxes in Oregon are relatively high, sitting at a state average of 0.82%, which should be factored into your overall cost of homeownership. Nonetheless, this absence of a sales tax can still be a compelling financial advantage when considering homeownership in the Beaver State.

Natural hazards

Oregon, while incredibly scenic, does have natural hazards like earthquakes, wildfires, and flooding that should be considered when buying a house. It’s important to assess the potential risks in your chosen area and take necessary precautions to ensure the safety and resilience of your new home.

Dual agency

Oregon allows dual agencies in real estate transactions, which means a single real estate agent or brokerage can represent both the buyer and the seller. However, buyers should be aware that this arrangement can present conflicts of interest, potentially affecting the advocacy and representation they receive during homebuying.

Buying a house in Oregon: Bottom line

Buying a house in Oregon offers many opportunities, from its diverse landscapes to its vibrant communities. With careful planning, thorough research, and the guidance of local experts, your journey to homeownership in Oregon can lead to a fulfilling and enriching experience in one of the most captivating states in the Pacific Northwest.

Buying a house in Oregon FAQs

How much does it cost to buy a house in Oregon?

The cost of a house in Oregon can vary significantly depending on factors such as location, size, and property condition. The median sale price is 511,100, and you’ll want to factor in the down payment, closing costs, and insurance. However, prices can be substantially higher in popular cities like Portland and Bend, while more affordable options can be found in rural areas or smaller towns.

What is the average down payment on a house in Oregon?

The typical down payment for a house in Oregon generally falls within 10% to 20% of the property’s purchase price. For example, on a $500,000 home, a 10% down payment totals $50,000, while a 20% down payment totals $100,000. However, these requirements can differ based on the type of mortgage, with FHA-backed loans often allowing a lower down price of approximately 3.5%, roughly $17,500 on a $500,000 home. Your down payment needs may also depend on your mortgage choice, lender policies, credit history, etc.

What credit score do you need to buy a house in Oregon?

To buy a house in Oregon, a good credit score is essential to secure favorable mortgage terms. While no specific minimum credit score is required to purchase a home, most lenders prefer borrowers to have a credit score of 620 or higher. However, aiming for a credit score of 700 or above is advisable to qualify for more competitive interest rates and loan options. Remember that credit requirements can vary between lenders, and factors like your income, debt-to-income ratio, and down payment will also influence your eligibility for a mortgage in Oregon.

The post The Ultimate Guide to Buying a House in Oregon appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.